By using this website, you agree to our Cookie Policy.

We strengthen your customer relationships and create sustainable customer loyalty with card-linked offers

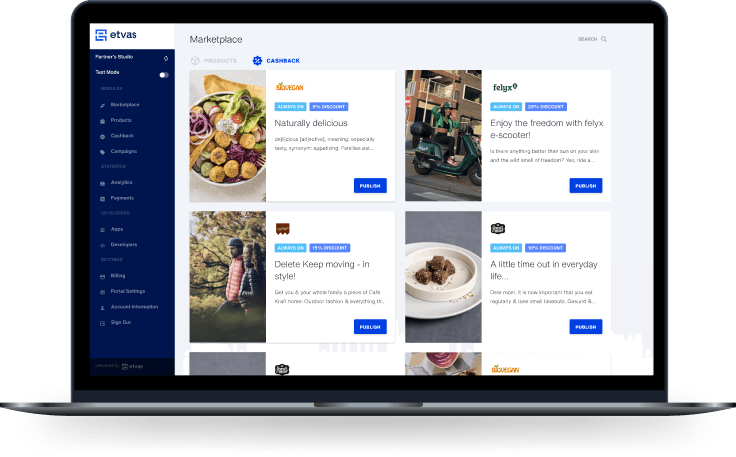

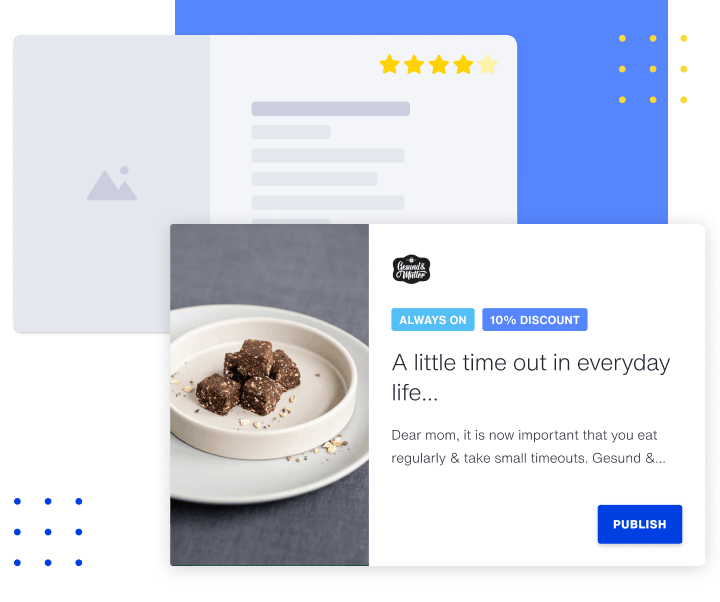

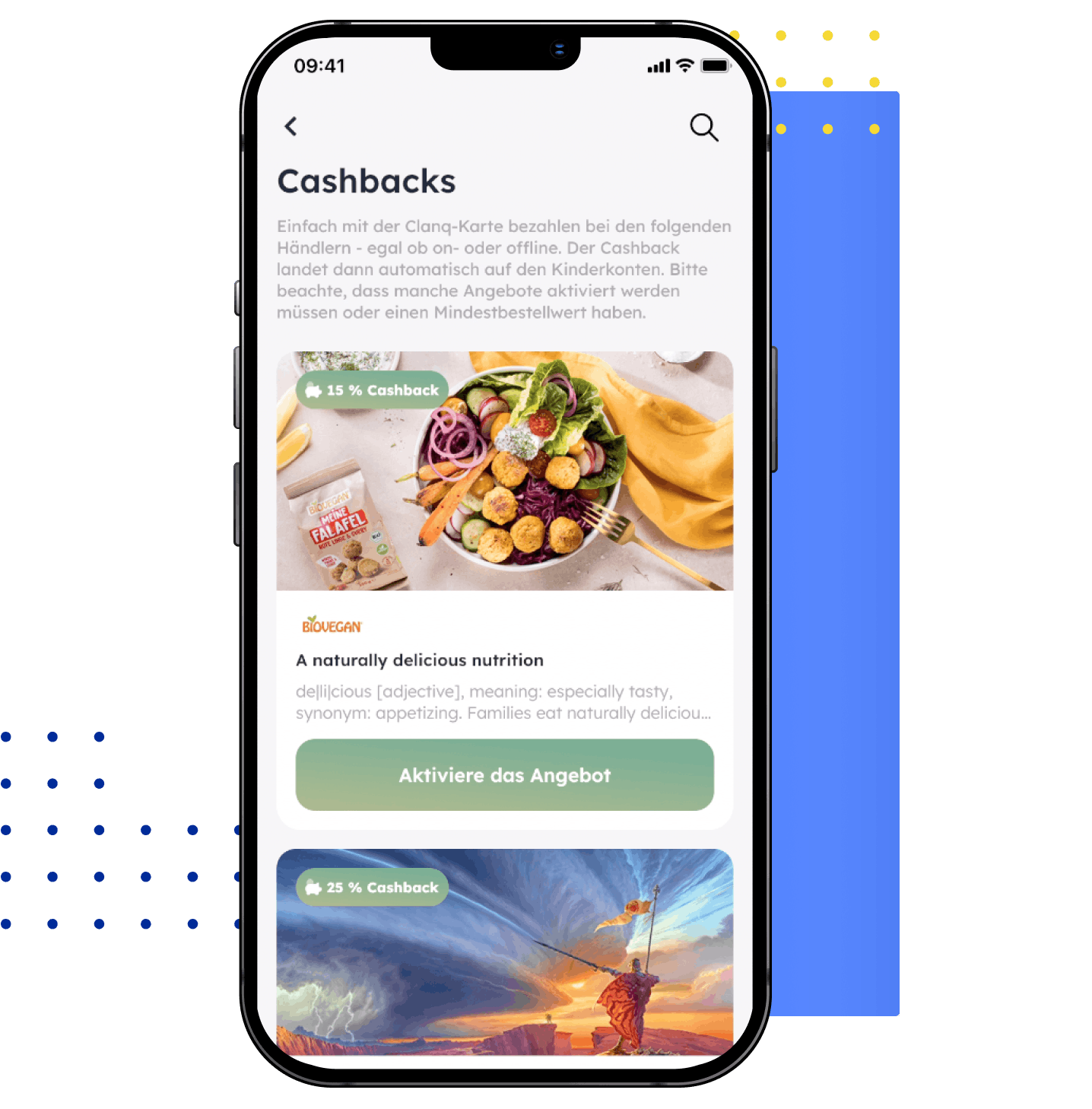

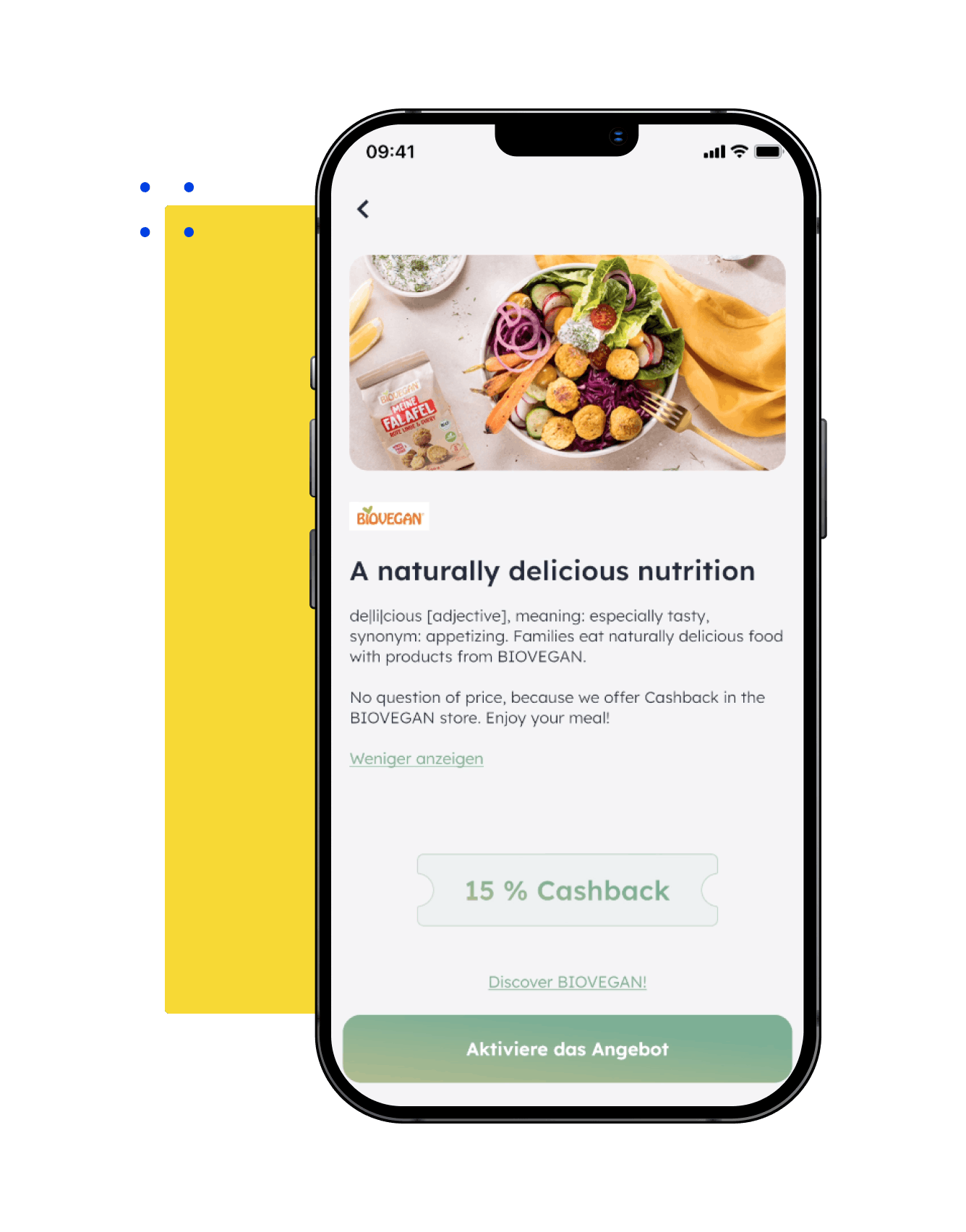

Don't just satisfy your customers! Surprise your clientele in their online banking with highly personalised Cashback offers on products that meet their current needs.

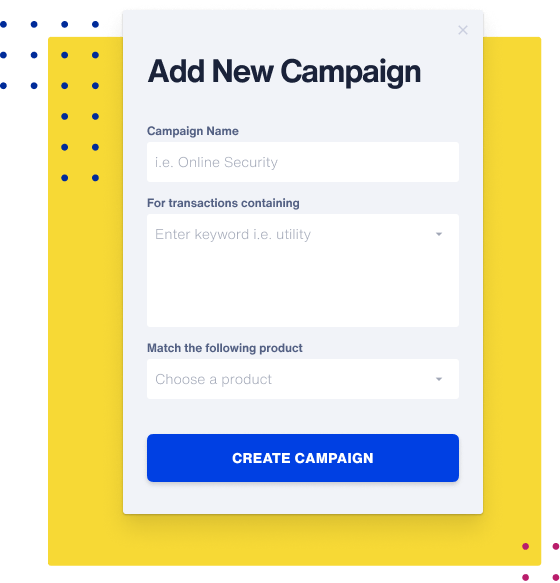

We support banks and brands in effortlessly optimising their customer acquisition and retention by rewarding their customers with personalised Cashback offers, using anonymised transaction data from card payments. Our card-linked offers reward platform creates consistent, high-quality customer experiences that lead to revenue growth.

Our vision is to reward every customer every day by providing Europe's leading rewards platform for card-linked offers (CLO). With CLO you:

With card-linked offers, you no longer need an integrated growth strategy.

Etvas is the first German SaaS platform for card-linked offers (CLO) that rewards customers. We match consumers with relevant brands in their daily online banking applications.

Based on anonymised card transaction data from online and point-of-sale (POS) payments, banks can offer targeted Cashback offers to their customers both online and offline.

Achieve satisfied customers with the combination of CLO and Cashback.

We believe that banking should bring maximum joy to every consumer. That's why we connect banking customers with their favorite brands through personalised, relevant offers and reward them in a magical way. Just like that!

Our innovative rewards platform rewards customers with Cashback offers while they shop. We connect offers from retailers and brands with customers through the banking channels of financial institutions.

The intelligent Etvas technology works with anonymised card transaction data to ensure the offers are highly relevant to consumers and perfectly match their current life situation. Moreover, the offers are valid for online purchases as well as point-of-sale (POS) purchases.

The best offer is the most relevant one

With Etvas card-linked offers we create a win-win-win situation

Consumers

are delighted with inspiration during their shopping experience and Cashback as a reward with Etvas.

Banks, FinTechs, Financial Services

activate their customers, leading to increased transaction volume and a higher share-of-wallet

Brands

acquire new customers efficiently and deepen existing customer relationships

Break away from traditional customer acquisition and retention strategies

• Position themselves as a trusted partner to their customers

• Strengthen customer loyalty

• Explore new revenue streams

Banks

• Address previously untapped customer segments

• Capture attention with relevant offers and incentives

• Reward with Cashback and help to save money

Brands

Little effort, big impact - always secure.

Personal Point of Contact

Our Customer Success Manager is always by your side, ensuring shared successes.

24/7 Support

Our technical 24/7 support ensures great customer experiences around the clock.

Fair Billing Model

Our pricing model is transparent and budget-friendly, optimizing your P&L.

Additional Revenues

Banks, FinTechs, and Financial Services pay a low set-up fee and licensing fees. They receive 10% of every Cashback paid out.

Transparent Payment Model

Merchants pay 20% on the Cashback amount paid out.

Effective Marketing

Optimize your marketing mix: Discover a profitable new marketing channel.

First Mover Advantage

Gain an advantage over your competition and be among the first partners to leverage card-linked Cashback!

Secure

Customer data remains secure. As a company based in Germany, we fully comply with the GDPR!